Why Profitable Systems Can Still Have No Real Value

*Applying insights from **Good Strategy / Bad Strategy** to real-world software businesses*

Introduction: Profit Is Not the Same as Value

Many software founders proudly say:

“Our product makes money.”

But Richard Rumelt, in Good Strategy / Bad Strategy, challenges this assumption with a powerful thought experiment — the famous “UFO machine” that produces $10 million per year.

The twist?

The machine may generate cash, but it has little strategic value once sold to another investor.

This idea is uncomfortable — and extremely relevant — for software businesses today.

The UFO Machine, Reframed for Software

Imagine this scenario:

- A SaaS product earns $1M per year

- It has customers and steady usage

- Anyone with a similar team can rebuild it in 6–12 months

On paper, it looks valuable.

Strategically, it may not be.

Like the UFO machine, its profits exist without a defensible reason.

Why Profit Alone Is a Weak Signal

Traditional business thinking equates value with:

- Revenue

- Growth

- EBITDA

- Multiples

Rumelt argues that strategy asks a deeper question:

Why does this profit exist — and why hasn’t competition erased it?

If the answer is vague, the value is fragile.

Transferability Test: A Simple Value Filter

A powerful way to test real value is this:

Does the advantage survive a change of ownership?

If selling the software means:

- Customers leave

- Margins collapse

- Differentiation disappears

Then the software was never the source of value — context was.

Boring Value vs. Interesting Value in Software

Boring Value

- Generic CRUD SaaS

- Feature-driven differentiation

- Easily copied UX

- Competes mainly on price

This is UFO-machine value: profitable but strategically thin.

Interesting Value (Rumelt’s Idea)

Interesting value comes from asymmetry:

- Knowledge others lack

- Position others cannot take

- Frictions others cannot cross

In software, this often looks like:

- Deep integration into operations

- Accumulated domain-specific data

- Workflow ownership

- Regulatory or cultural specificity

Real Software Examples of Interesting Value

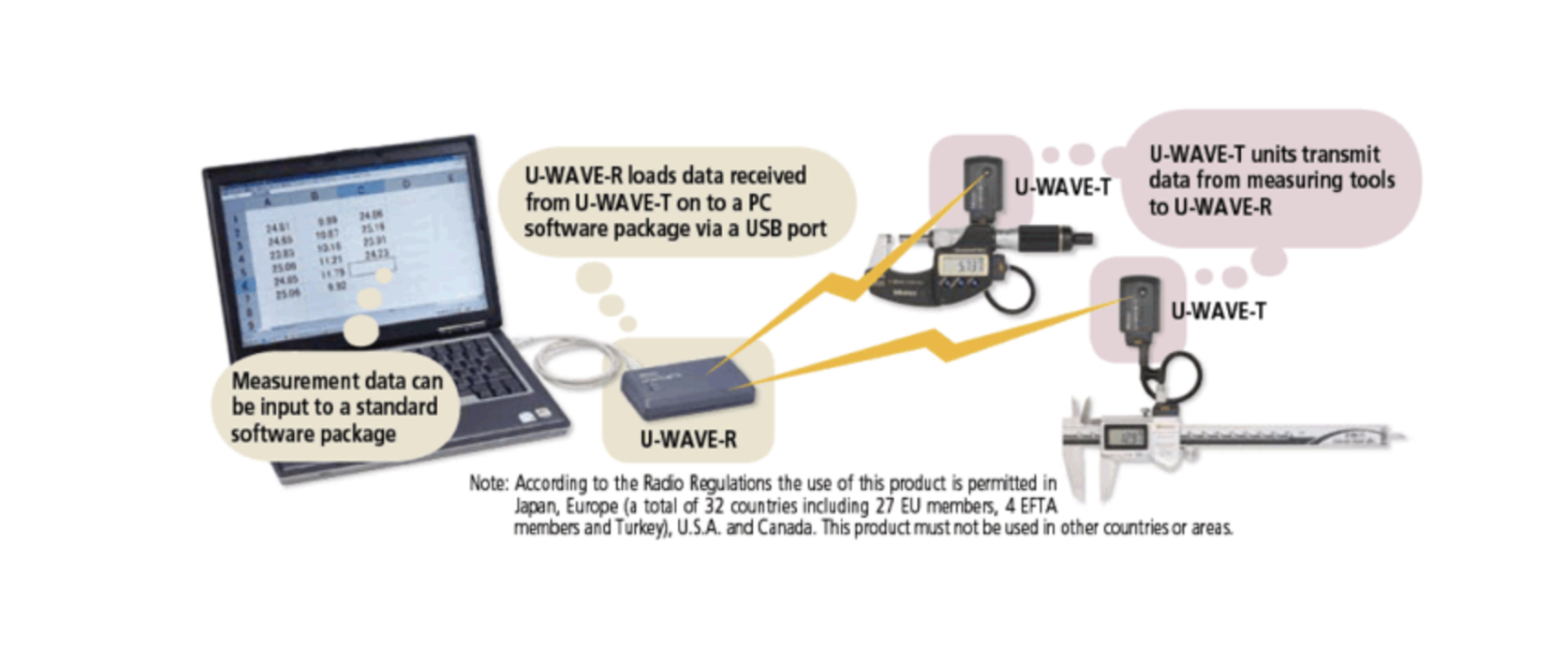

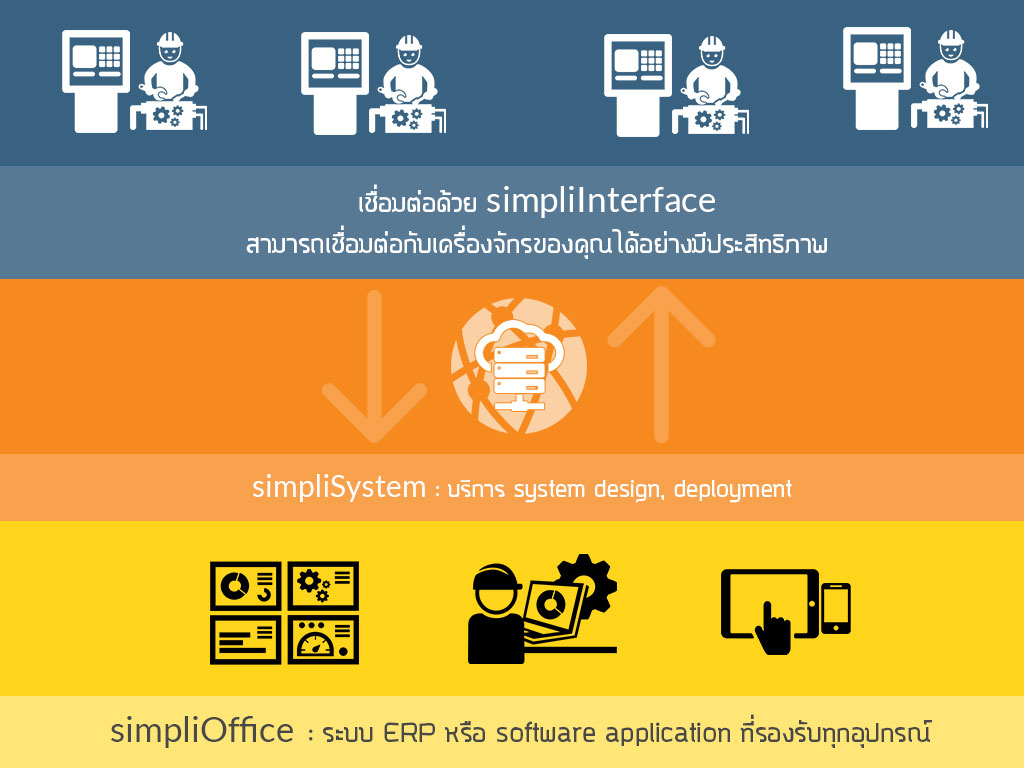

1. Embedded Workflow Software

Software that becomes part of how work is done:

- MES inside factories

- Accounting systems tied to local regulations

- Industry-specific operational tools

Replacing it is painful — that pain is value.

2. Data That Improves the System

When usage creates data that:

- Improves predictions

- Refines workflows

- Increases switching costs

The value compounds over time and cannot be sold as code alone.

3. Relationship-Centered Platforms

Some systems work because of:

- Trust

- Long-term support

- Operational knowledge

The software is only one layer — the value lives in the relationship.

Why Many Profitable SaaS Still Struggle

Founders often optimize for:

- Feature velocity

- Short-term MRR

- Investor narratives

Instead of:

- Durable advantage

- Strategic position

- Long-term defensibility

The result?

A profitable product with no moat — easy to replace, easy to ignore.

graph LR

A["Profitable System ≠ Strategic Value"]

A --> B["Cash Flow"]

B --> B1["Revenue"]

B --> B2["EBITDA"]

B --> B3["Short-term Profit"]

A --> C["Boring Value"]

C --> C1["Generic Software"]

C --> C2["Copyable Features"]

C --> C3["Price Competition"]

C --> C4["UFO Machine"]

A --> D["Interesting Value"]

D --> D1["Asymmetry"]

D1 --> D1a["Unique Knowledge"]

D1 --> D1b["Unique Position"]

D1 --> D1c["Unique Context"]

D --> D2["Embedded Systems"]

D2 --> D2a["Hardware + Software"]

D2 --> D2b["Operational Workflow"]

D2 --> D2c["Physical Constraints"]

D --> D3["Data & Learning"]

D3 --> D3a["Accumulated Data"]

D3 --> D3b["System Improvement"]

D3 --> D3c["Switching Cost"]

D --> D4["Relationships"]

D4 --> D4a["Trust"]

D4 --> D4b["Long-term Support"]

D4 --> D4c["Consulting Know-how"]

A --> E["Strategy Test"]

E --> E1["Transferability"]

E1 --> E1a["Ownership Change"]

E1 --> E1b["Does Advantage Survive?"]

E --> E2["Defensibility"]

E2 --> E2a["Moat"]

E2 --> E2b["Friction"]

E2 --> E2c["Replacement Pain"]Strategy Question Every Software Founder Should Ask

Before adding another feature, ask:

What makes this software harder to replace next year than today?

If the answer is unclear, profits may be temporary.

Final Thought: Build Position, Not Just Products

The UFO machine teaches a quiet lesson:

Money is an outcome — not a strategy.

In software, lasting value comes from position, not features.

The most valuable systems are often:

- Hard to explain

- Hard to transfer

- Hard to replace

And that is exactly why they endure.

*Inspired by ideas from Richard Rumelt’s *Good Strategy / Bad Strategy

Get in Touch with us

Related Posts

- AI驱动的 Network Security Monitoring(NSM)

- AI-Powered Network Security Monitoring (NSM)

- 使用开源 + AI 构建企业级系统

- How to Build an Enterprise System Using Open-Source + AI

- AI会在2026年取代软件开发公司吗?企业管理层必须知道的真相

- Will AI Replace Software Development Agencies in 2026? The Brutal Truth for Enterprise Leaders

- 使用开源 + AI 构建企业级系统(2026 实战指南)

- How to Build an Enterprise System Using Open-Source + AI (2026 Practical Guide)

- AI赋能的软件开发 —— 为业务而生,而不仅仅是写代码

- AI-Powered Software Development — Built for Business, Not Just Code

- Agentic Commerce:自主化采购系统的未来(2026 年完整指南)

- Agentic Commerce: The Future of Autonomous Buying Systems (Complete 2026 Guide)

- 如何在现代 SOC 中构建 Automated Decision Logic(基于 Shuffle + SOC Integrator)

- How to Build Automated Decision Logic in a Modern SOC (Using Shuffle + SOC Integrator)

- 为什么我们选择设计 SOC Integrator,而不是直接进行 Tool-to-Tool 集成

- Why We Designed a SOC Integrator Instead of Direct Tool-to-Tool Connections

- 基于 OCPP 1.6 的 EV 充电平台构建 面向仪表盘、API 与真实充电桩的实战演示指南

- Building an OCPP 1.6 Charging Platform A Practical Demo Guide for API, Dashboard, and Real EV Stations

- 软件开发技能的演进(2026)

- Skill Evolution in Software Development (2026)